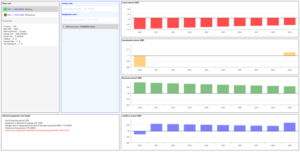

With the module Investment Analysis, proposed investment plans can be evaluated and compared for determining the most financially viable option.

The calculation is performed with the Net Present Value as basis. The required financial input data are provided by the user e.g. discount rate, energy cost, maintenance costs etc. while the technical required data are calculated, e.g. losses, energy consumption, etc.

The outcome is a complete techno-financial evaluation and the user has a transparent image of each investment plan. This helps to find the costs-optimal solution.

General Characteristics

- Various secondary indexes are available e.g. Pay Back Period, Internal Rate of Return etc.

- Losses are calculated on an annual basis and the energy is estimated

- Consideration of load-dependent costs (copper losses) and of load-independent costs (magnetization, weather-dependent corona, and dielectric losses)

- Equipment’s investment data with sub-component costs are available in libraries.

- Revenues from energy selling are considered.

- Results are shown not only in tables but also in charts for intuitive assessment and comparison.

- and more…